Despite its first appearance nearly a decade ago, Cryptocurrency has exploded into the public view this year – mainly due to Bitcoins meteoric rise in the last few months. At the end of 2017, there are well over a thousand different digital currencies available to trade with a vast disparity in value. Although the initial adoption was slow, its use is rapidly increasing, leading to many businesses beginning to accept the digital currencies as payment.

Cryptocurrency is a digital currency for which encryption techniques are used to regulate its use and generates its release. Unlike common currencies – such as the British Pound, US Dollar, or the Euro – cryptocurrency is not regulated or controlled by any bank, government or centralised financial authority. These currencies are run on a distributed public ledger known as Blockchain, where a record of all transactions are updated and held by the currency holder only.

Despite cryptocurrencies only recently making front page news, businesses around the world have been accepting them as payment for a number of years. Expedia, for example, have been accepting Bitcoin as payment for hotel bookings since 2014 after partnering with Coinbase. Zynga, the online game developer, has also been accepting Bitcoin in partnership with BitPay for the in-app purchases.

...but should your business start accepting it?

Benefits

Lower Transaction fees

As digital currencies are not processed by any bank or centralised financial authority, all transactions have a much lower fee ranging from a few pence to a maximum 1% per transaction. In comparison to credit and debit card, the transactions fees can be as high as 3-5%. For businesses that receive small, high frequency transactions such as coffee shops or eCommerce, using a digital currency would incur a minimal / no fee per transaction.

My company ships to more than 60 countries around the world and thanks to cryptocurrencies we saved more than $17,000 solely in processing fees

— Lee Marburg, founder of a Bitcoin-only online electronics store

Last year was the first time that card payments by consumers overtook cash, which now accounts for 42.6% of all transactions. The rise in this has resulted in increased fees for businesses but by accepting cryptocurrencies allows consumers to continue using cashless pay methods and reduces the amount spent of transaction fees.

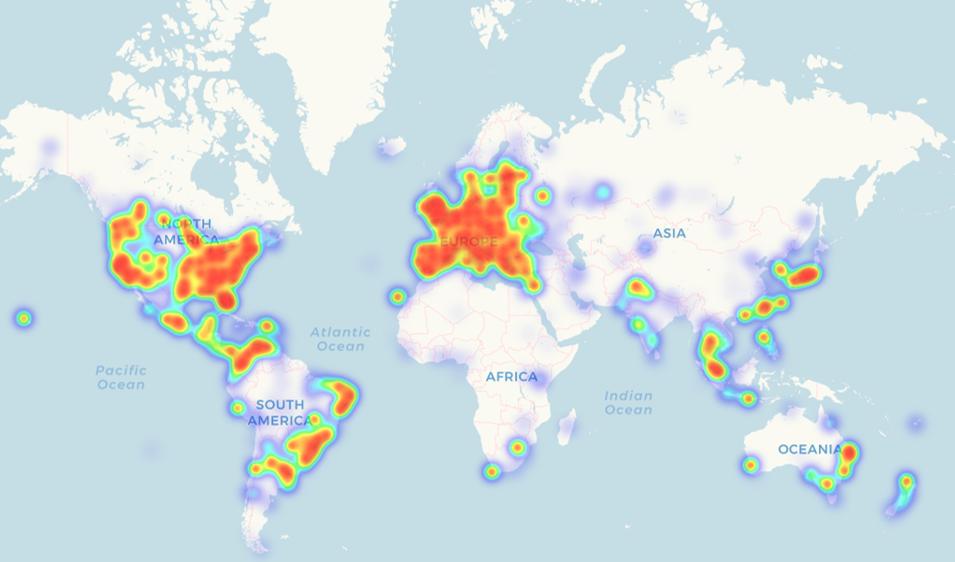

Global accessibility

There are 7.6 billion potential customers on the planet but for small businesses, there has been a number of prohibitive barriers to contend with. In many cases, the costs of accessing customers across boarders are too high; calculating exchange fees and currency fluctuations are off-putting factors for many small enterprises – but this is about to change. It is estimated that 300,000 new Bitcoin wallets are downloaded each month, with that number expected to rise further. By offering cryptocurrency as a payment option will open your doors to an increasing customer base thus enables access to customers overseas. Currencies such as Bitcoin, Dash, and Ethereum, among others, offer lightning-fast transactions across boarders that can easily be converted into the native currency at a minimal fee. This enables organisations, small and large, to capitalise on previously unexplored markets.

Lower risk of fraud

The use of cryptocurrencies carries a reduced risk of fraud for both customer and business. Unlike using credit cards, where a plethora of personal customer data is transferred to the business after a purchase, cryptocurrencies are totally anonymous and no personal information is transferred. Cyber-attacks on businesses are becoming more advanced and frequent each year, rising with the amount of personal data available. By removing the data within the purchase process, the chances of fraud are reduced significantly.

Considerations

Pricing fluctuations

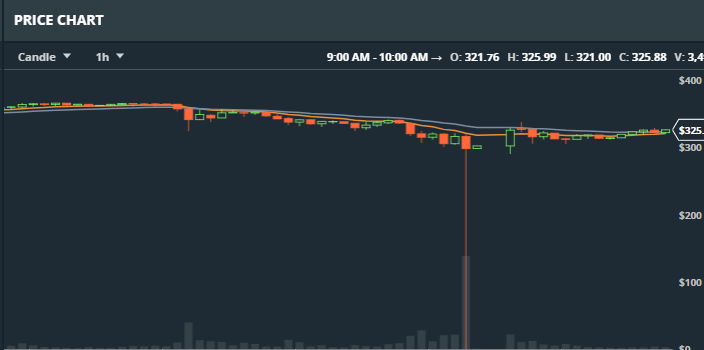

The price of Bitcoin and the other cryptocurrencies are highly speculative due to factors that drive the value. Factors such as its perceived value and the actions of large shareholders result in high levels of volatility – which can have a negative effect on businesses accepting cryptocurrency.

The biggest risk is the chance of a currency going through a “flash crash”. This is when the value drops to extreme lows in a matter of seconds. For example, Ethereum recently went through a flash crash, sending its value to $0.10 from $319. Although many merchant wallets convert coins automatically to mitigate the effect of a flash crash, due to the almost instant drop that can occur, it may not be fast enough. This will mean businesses will have to sit on their coins until the price returns to its original value, but there is always the risk it will not recover.

Lack of regulation

The regulations around cryptocurrencies have not been established in many countries and are often misunderstood by law-makers. As governments are working on crafting regulations to govern the digital currency, it may be some time before anything is set in stone due to the constantly evolving environment. It is likely, however, that due to the decentralised and ‘’anti-establishment’’ nature of the currency that financial authorities and governments may attempt to stop or at least control the technology.

So, should your business start accepting cryptocurrency?

There is no binary answer. The current benefits are appealing, especially to small businesses looking to expand internationally, however, acceptance should be treated with caution. Any business undertaking use of cryptocurrency should be prepared and informed for volatility within markets, aware of the risks associated and be equipped to adapt to the periodic changes in the regulation that will likely to come to fruition in the coming years.