It’s been an eventful year. After a remarkably strong performance in 2021, private equity in the UK experienced more difficulty in 2022, particularly in the second half of the year. Going into 2023, investors were feeling cautiously optimistic about what the year ahead would hold. In this article, we look back on 2023, dissecting some of the year’s most significant moments and market reactions.

Navigating the Slowdown: UK Private Equity Deal Volumes Slide

In late 2022, the UK experienced the highest inflation of any advanced economy, peaking at 11%. Stubbornly high inflation, geopolitical uncertainty and high interest rates have not aided the UK’s growth prospects. The first half of 2023 was not as fruitful as the previous year—deal volumes in the UK were down 35% compared to H1 2022 and down 51% compared to H1 2021. While deal volumes stagnated, record amounts of dry powder remained in the private equity markets. However, this was not all bad news because it created a highly competitive landscape for high-quality businesses with ambitious and forward-thinking management teams.

Sector-Specific Performance: TMT Comes Out on Top

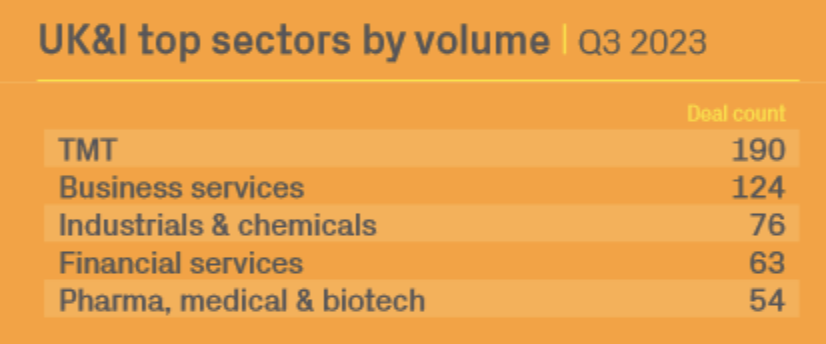

Deal volumes may have been down compared to H1 2022, but some sectors still managed to attract high levels of private equity interest. In Q3 2023, for example, the top sectors by volume in the UK and Ireland were TMT (190 deals), business services (124 deals), industrials and chemicals (76 deals), financial services (63 deals) and pharma, medical and biotech (54 deals).

Technology remains a key sector for private equity in the UK. Notable deals include Schneider Electric’s acquisition of AVEVA for $4.4 billion and OpenText’s acquisition of UK software and IT services firm Micro Focus, which is estimated at $5.8 billion. Investors are attracted to the TMT industry’s growth potential, its relative resilience in the face of strong macroeconomic headwinds and its integration into other high-performing sectors like healthcare, finance and industrials.

Healthcare is Gathering Steam

Healthcare is another sector that private equity firms have their eye on, citing their ability to run companies more efficiently, invest in better technology and play a key role in helping the NHS tackle long waiting lists and other problems. Since 2021, private equity firms have made at least 150 deals for UK healthcare companies. The recent influx of private equity funds into UK healthcare shows the growing influence of financial services in the sector, which is likely to continue into 2024.

Industrials: Manufacturing and Energy in the Spotlight

The UK industrials sector showed signs of resilience this year. Analysis by Make UK found that there was a jump in manufacturing output to £224 billion, meaning the UK climbed from 9th to 8th place in the global manufacturing rankings. Energy has also been pushed to the top of many agendas, and several main themes dominate the landscape: energy security, commodity prices, climate change and energy transition. The UK’s commitment to achieving net zero by 2050 necessitates substantial investment in the renewable energy sector and may require over £900 billion in investment to achieve the target.

Consumer Markets: Down, But Not Out

However, other sectors did not fare so well. Due to energy, supply chain and labour issues, consumer markets and industrials struggled in comparison to previous years. These factors, compounded by concerns about a potential recession, made the operating environment challenging. For consumer markets, M&A activity has been muted in 2023, particularly during the first half of the year.

The good news is that consumer sentiment is showing signs of recovery. A mid-year consumer pulse survey found that 50% of consumers planned to increase their online shopping activity between June and December 2023. As macroeconomic headwinds such as stubborn inflation and high interest rates ease, consumer sentiment should continue to improve, with a positive knock-on effect for consumer markets.

Untimely Disruption: The Collapse of Silicon Valley Bank

If the first quarter of 2023 had to be defined by one event, it would be the banking crisis. The collapse of Silicon Valley Bank (SVB) sent shockwaves through the financial world, including UK private equity. The bank provided debt financing to private equity firms and tech start-ups, and its sudden collapse left a void in the market. To make matters worse, the collapse could not have come at a worse time. Many private equity firms were already experiencing fundraising difficulties in late 2022 and early 2023.

Private equity firms that had used SVB for financing were forced to scramble to find alternative lenders. The UK government, including the Bank of England, responded to the collapse by seeking solutions to mitigate its impact on British technology firms, which were heavily reliant on SVB. However, some firms saw SVB’s collapse as an opportunity to expand their private credit businesses, hoping to benefit from new clients created from the vacuum left by SVB.

AI Makes a Comeback

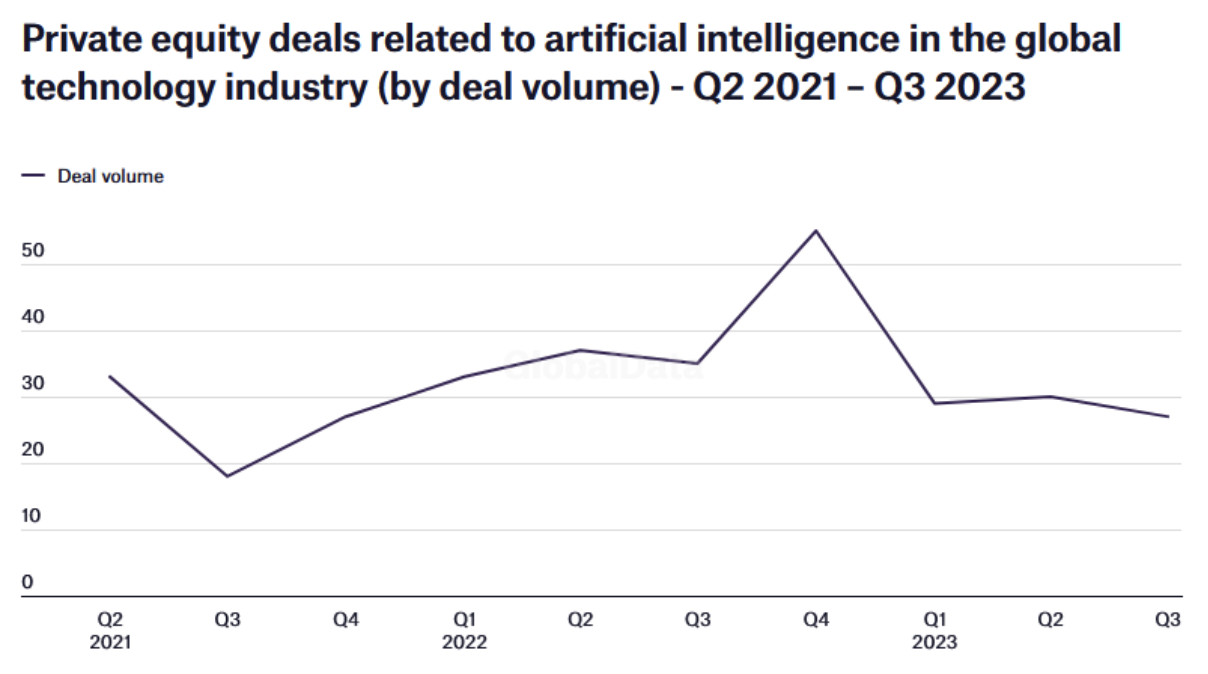

You cannot recount the events of 2023 without mentioning artificial intelligence. However, AI had a more muted start to the year after 2022’s frantic deal activity, where private capital investment reached £3 billion. In contrast, the first quarter saw AI deals worth only $432.3 million, but as the year went on, investor interest in AI gathered steam once again. In Q3 2023, 27 technology deals worth a total of $2 billion were announced, increasing by 289% compared with the previous quarter’s total of $513.6 million.

The UK’s Office for Artificial Intelligence makes the country an attractive destination for AI investment. In November, the UK hosted the AI Safety Summit at Bletchley Park in Buckinghamshire. The summit, which brought together international governments, AI companies, civil society groups and AI research experts, explored the risks of AI development and internationally coordinated risk mitigation action.

Not only did this event lay the foundations for future AI discussions, it helped to present the UK as an AI leader, beaten only by the United States and China. AI leader status will significantly enhance the UK’s appeal for private equity investment in AI technologies.

November’s Political Shakeup

In the penultimate month of the year, politics experienced a major shakeup. In mid-November, the Home Secretary was sacked from her role and returned to the backbenches. To almost everyone's surprise, a familiar face entered Downing Street as Foreign Secretary. A couple of days later, ONS data revealed that the CPIH rose by 4.7% in the 12 months to October 2023, down from 6.3% in September. Jeremy Hunt recently unveiled the Autumn Statement. So, what did the markets make of these political and economic developments?

Cabinet Reshuffle: Ex-Prime Ministers and Other Familiar Faces

On the morning of the recent cabinet reshuffle, jaws dropped all over the country when David Cameron walked into Downing Street. Back from the political wilderness, the ex-Prime Minister was appointed to the House of Lords to take up the role. The shock appointment has been a source of intrigue and controversy, partly due to Cameron’s post-Brexit vote resignation from the top job and the 2021 Greensill scandal.

But Cameron’s return wasn’t the only notable change. Several ministers left their roles or moved to new posts. James Cleverly replaced Suella Braverman as Home Secretary, Steve Barclay was moved to the role of Environment Secretary, and Victoria Atkins took up the role of Health Secretary. Jeremy Hunt kept his job as Chancellor of the Exchequer despite being viewed as too moderate by some tax-cut-hungry Conservatives.

The market response to the cabinet reshuffle was modest—sterling saw a 0.2% increase, while the FTSE 100 rose 0.6%. However, it’s important to note that the reshuffle was a domestic political manoeuvre, so a dramatic market reaction was not on the cards. The announcement that the inflation rate had dropped was of far more interest to financial markets.

Inflation is Falling—But Don’t Get Too Excited

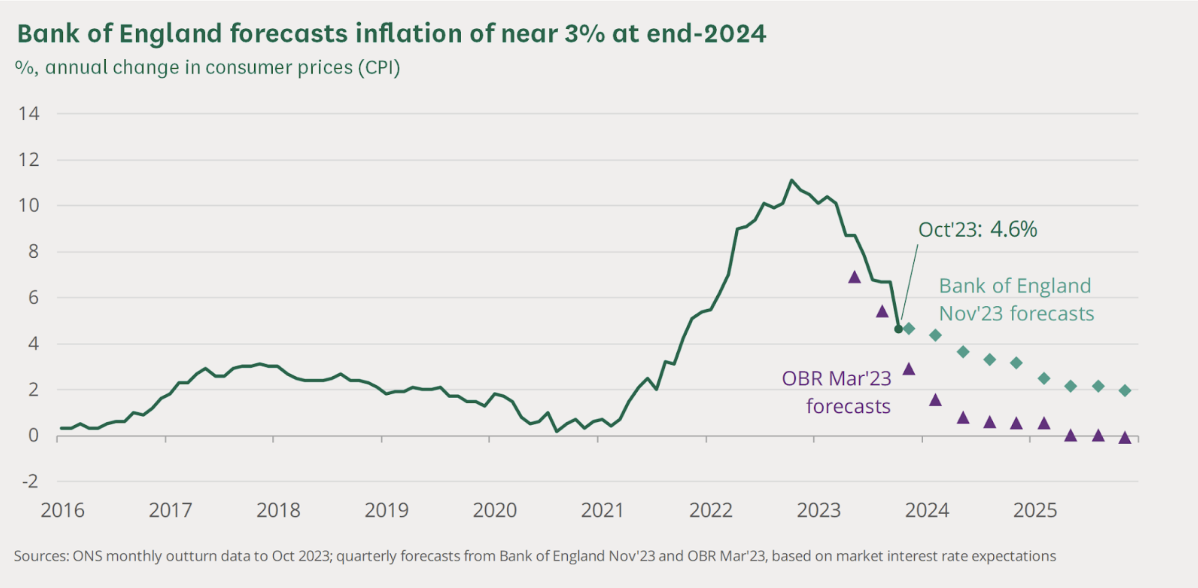

A couple of days after the cabinet reshuffle, the Office of National Statistics (ONS) released data that revealed the UK’s annual inflation rate fell to 4.6% in October, mainly due to cheaper gas and electricity. The easing of inflation rates reflected negative contributions from several areas, including housing and household services, alcohol and tobacco and transport.

The news that inflation continues to slow down has brought a sense of relief to consumers and businesses, as lower inflation eases the cost of living and operational costs. This decline is expected to continue over the coming months, with the Bank of England predicting inflation will return to the 2% target by the end of 2025.

On the release of the data by the ONS, Chancellor Jeremy Hunt reacted with optimism, stating: “Now we are beginning to win the battle against inflation, we can move to the next part of our economic plan, which is the long-term growth of the British economy.” After the data was published, the FTSE 100 rose more than 1% to its highest level in almost a month.

However, the Bank of England Governor, Andrew Bailey, has warned markets against underestimating the persistence of UK inflation. Speaking to MPs on Tuesday, Bailey said he thought that investors were putting “too much weight” on the recent data on inflation. The Bank’s warnings led to a more downbeat mood for investors, who felt generally optimistic when the inflation figures were released last week.

The news that interest rates will likely remain high for some time is not welcome news for the private equity sector. Private equity firms thrived during the era of “cheap money”, so the news that interest rates will be higher for longer will mean debt remains expensive to service.

The Autumn Statement: A Path to Growth?

On Wednesday, 22nd November, Jeremy Hunt laid out his tax and spending plans in his Autumn Statement. The Chancellor announced a National Insurance cut from 12% to 10%, a boost to the National Living Wage from April 2024, and full expensing is now permanent.

One of the most impactful announcements for businesses across the UK was that full expensing is now permanent. Businesses can claim back 25p in corporation tax for every £1 invested in IT, machinery and equipment, which will cost the Treasury £11 billion a year. The government estimates that this will boost business investment by £14 billion across the forecast period, helping to grow the economy.

The good news for investors keeps coming, as extra capital will be available for VCs in the UK to invest in high-growth industries such as technology and green energy. The government committed a further £500 million over the next years for access to artificial intelligence compute, bringing the total planned investment to £1.5 billion. But other industries also benefit from today’s announcement, including the UK’s life sciences industry. In total, £4.5 billion in funding has been made available to unlock private investment in what Hunt called “strategic manufacturing sectors”, which is good news for UK businesses.

However, all is not as rosy as it first seems. The policy announcements are being somewhat overshadowed by The Office of Budget Responsibility (OBR) downgrading its forecasts for growth for the next couple of years. The OBR said the economy would grow by 0.7% in 2024 and 1.4% in 2025, down from the March forecast of 1.8% and 2.5%.

Reactions to the Autumn Statement have been somewhat muted. The blue-chip FTSE was 0.09% lower as of 1:30 pm on Wednesday when the statement was coming to a close. Bond markets wobbled ahead of the statement but cooled down on Wednesday afternoon after the Chancellor unveiled 110 measures to stimulate growth.

The big announcement for businesses was the changes to full expensing, an initiative the CBI thinks will have “the single most transformational impact on business investment and growth.” Making full expensing permanent is likely to have a positive impact on private equity firms, making investment in the UK more attractive due to offsetting some investment costs against taxable profits.

Mixed Reactions to Political Upheaval

After an eventful couple of weeks, which included a controversial cabinet reshuffle, news about falling inflation, and an eagerly awaited Autumn Statement from the Chancellor, the markets have given their verdict. The reaction has been mixed. Initial positive reactions were quickly tempered with new developments, be it warnings about stubborn inflation or lowered growth forecasts.

The revelations of the last few weeks have given private equity firms a lot to think about. The economic shifts and policy announcements outlined in the Autumn Statement provide both opportunities and challenges. In response, private equity firms will need to balance their investment strategies carefully.

Looking Ahead: A General Election Looms

Within the next 13 months, there will be a general election in the UK. While there are no manifestos for us to pour over just yet, we do know that political change usually brings market volatility. Policy changes to taxes and regulations affect private equity performance. As a result, the financial world will be keeping a close eye on developments in the run-up and aftermath of the election.

The private equity sector is actively assessing the potential impacts of a change of government at the next election. This assessment is vital given the sector’s growing economic influence in the UK. In November, the Financial Times reported that private equity executives are already approaching Labour, presenting themselves as friends to the party. The article said: “Private equity executives are preparing a campaign to water down Labour’s promise to end their favourable tax treatment in the UK as they build closer ties with the opposition party ahead of the general election.”

Since the initial 2021 pledge to close a tax loophole that allows buyout bosses to pay less tax on part of their earnings, relations between Labour and private equity executives have warmed somewhat, with the party signalling its intent to bring public and private funds together to increase low-carbon energy production. Only time will tell which party will spend the next half-decade governing the country. With rumblings about an early general election, we may have our answer sooner than we think.

Reflecting on UK Private Equity in 2023

It has been an eventful and rather challenging year for private equity firms in the UK. As 2023 comes to a close and executives pack up their things to head home for a much-needed break, there are plenty of moments from this year for them to mull over. From dealing with the fallout of the SVB banking crisis to a very welcome fall in inflation, the UK private equity sector appears to be heading for calmer waters.

Private equity is undergoing an adjustment period, defined by higher rates and market uncertainty. However, the performance of the sector during other periods of market volatility points to its inherent adaptability. This adaptability, which stems partly from the long-term investment horizon typical of private equity, allows firms to weather short-term market fluctuations and focus on creating value in the long term.

With 2024 fast approaching, Palladium is ready to guide your business through the investment cycle, from due diligence to post-deal value creation. Our approach involves identifying and driving opportunities for digitally-led change, leading to accelerated growth and successful exits. Contact us today to learn more about how we can assist you wherever you are in the investment cycle.

Please don’t hesitate to contact us to learn more about our AI Impact Assessment.