Artificial intelligence (AI) has quickly evolved from a futuristic, somewhat otherworldly concept to a tangible asset that investment firms are leveraging to gain a competitive edge. The relatively recent explosion of big data and machine learning techniques provided by organisations such as OpenAI, Microsoft and Google have laid the foundations for further integrating AI into investment firms. However, until recently, AI technologies had only been embraced by a small number of forward-thinking firms.

How is AI Used in Investment Firms?

Fast-forward to today, and the situation couldn’t be more different. Investment firms are jumping at the opportunity to integrate AI into day-to-day operations. AI undoubtedly presents a vast array of opportunities for firms, including advanced data analytics, due diligence automation, enhanced market research, improved financial modelling and forecasting, personalised client engagement and expertise development. However, it is essential for firms to realise that there are right and wrong ways to integrate AI into their operations. In this article, we will explore the role of AI in investment firms, including the opportunities and threats it poses.

The Good: Opportunities for AI Integration

Let’s start by exploring the opportunities for firms to integrate AI into their operations:

AI-powered data analytics

AI allows firms to process and analyse large volumes of data efficiently and accurately. Machine learning algorithms allow for the identification of potential investment opportunities from market trends, industry performance, public company financials and macroeconomic indicators to predict future asset price movements. For example, Palladium’s SaaS product Prism leverages AI to analyse public data about target businesses, key competitors and the wider market to help firms better understand potential investment opportunities.

AI also allows investment firms to closely monitor portfolio performance in real-time by analysing market data and portfolio holdings, alerting investment managers to potential issues or opportunities. But that’s not all—AI can also produce tailored recommendations for growth strategies by analysing market trends and company performance. This might involve recommending investments in specific high-performing sectors, emerging geographies or different types of assets.

Automating due diligence

Depending on the complexity of the transaction, the due diligence process can take anything from a couple of weeks to several months to complete. AI can streamline the process significantly by automating routine tasks such as data extraction, financial analysis and document review to flag areas that may require further scrutiny. Not only does automating aspects of the due diligence with AI save firms valuable time, but it also has the potential to produce more accurate, higher-quality recommendations.

Enhanced market research

AI has also increased the speed and accuracy of market research. Natural language processing (NLP), an AI subfield, allows computers to understand, interpret and generate human language. NLP allows for the analysis of unstructured data from sources such as news articles, reviews and social media posts, allowing firms to glean deep insights from data sources that were previously inaccessible due to the time investment required.

For instance, NLP interprets the tone behind words to gain an understanding of the attitudes, emotions and opinions expressed online, allowing firms to conduct sentiment analysis on target assets, competitors and entire sectors.

Improved financial modelling and forecasting

AI presents exciting opportunities to transform financial modelling and forecasting. Financial modelling, a traditionally labour-intensive process requiring extensive financial knowledge, can be significantly enhanced by AI.

For example, AI algorithms can improve financial modelling and forecasting by processing large amounts of data incredibly quickly, analysing it for market trends, economic indicators and company performance metrics. AI has the ability to identify complex patterns between data that may not be visible to human analysts, providing firms with more accurate financial forecasting.

Personalised client engagement

AI is also enabling a degree of personalisation that was previously unattainable by investment firms. AI-powered tools, such as chatbots and virtual assistants, open up new possibilities for improving client interactions, making them more timely, but tailored to unique needs. Chatbots, for example, can interpret and respond to client enquiries instantly, answering common questions. But the personalisation opportunities do not end there. Furthermore, AI-powered virtual assistants can refine the client engagement process by learning from interactions with investors—a strategy J.P. Morgan implemented back in 2018.

The Bad: The Threats of AI

While AI offers a plethora of benefits, it also presents risks that must be taken into consideration before incorporating AI:

Security risks

AI poses serious security risks if the implementation is not correctly managed, and recognising these threats and implementing appropriate countermeasures is essential to firms’ security. Because AI systems process large volumes of sensitive data, they are targets for bad actors. Breaches may have disastrous circumstances, such as the leaking of confidential information like financial data, client details and investment strategies.

Several companies have restricted the use of ChatGPT because of the associated security risks. For example, Apple has banned the use of ChatGPT and similar tools internally out of concern that workers could release confidential data. Samsung did the same after discovering staff uploaded sensitive code to the platform.

To manage the information being shared with AI, companies are licensing the software and putting enforceable legal agreements into place about data usage. Another option for firms is to develop their own GPT or hire experts to create a custom version tailored to their specific needs. PrismGPT is a secure area that we have developed for clients in which to operate the efficiencies securely. This route allows companies to have better control over the information employees access and, vitally, safeguard the confidential information fed into the platform.

Job losses

Integrating AI into the investment sector will undoubtedly create new opportunities, but it also renders some tasks and roles redundant, which may lead to job losses. For example, AI will lead to the automation of routine tasks and will affect roles focused on data entry, basic data analysis and some aspects of the due diligence process.

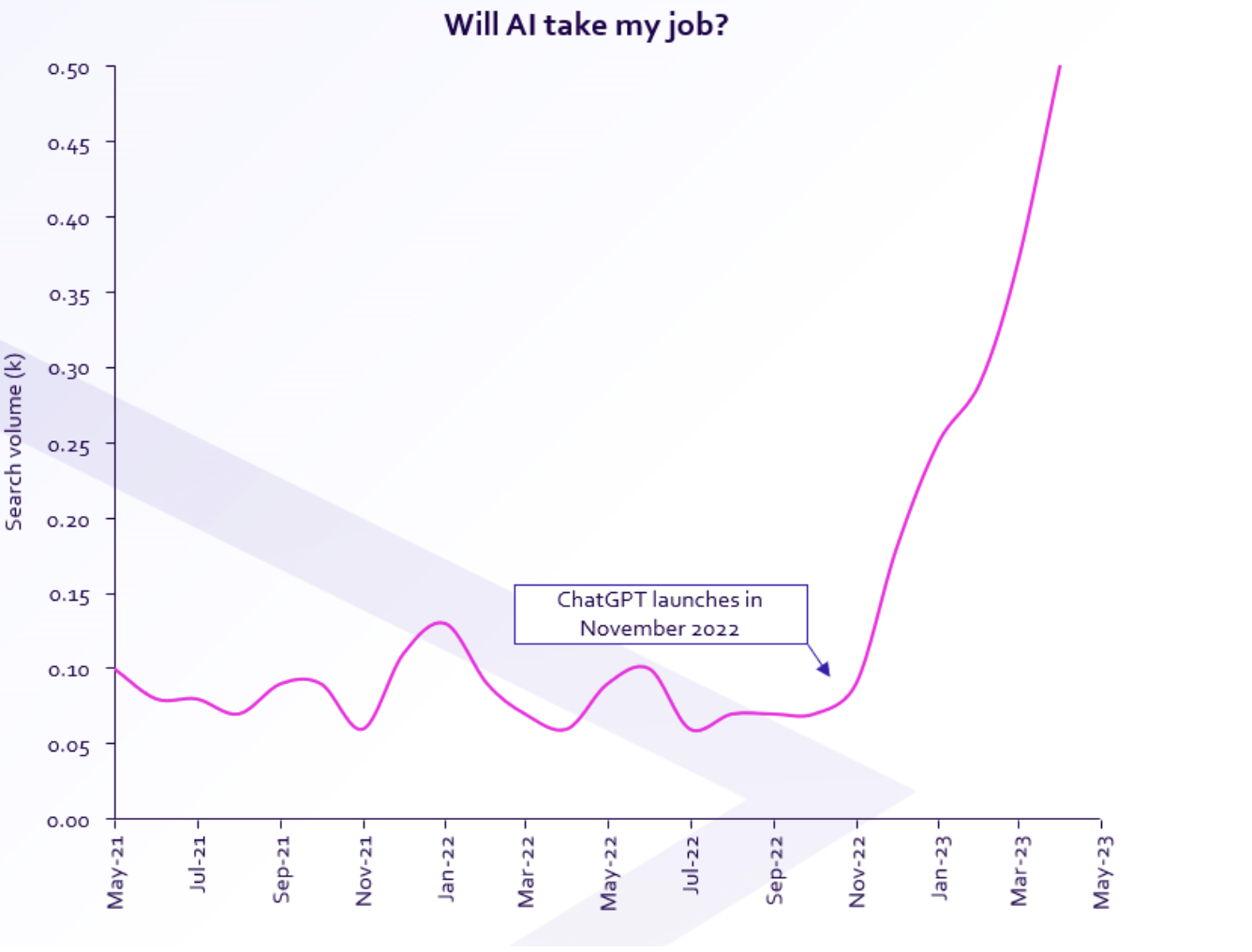

In the wider population, some are worried about how AI will impact their roles since the launch of ChatGPT. The number of searches for the query “Will AI take my job?” saw a 108% year-on-year rise between May 2022 and April 2023. Similarly, queries signifying existential worries, such as “Is AI dangerous?” experienced a 144% rise in the same time period.

While AI may replace certain tasks, it cannot yet fully replicate human skills such as creativity, emotional intelligence or advanced critical thinking, skills which remain in high demand in investment firms. But AI is likely to impact more roles as time goes on. Klee explained that, over time, roles would almost certainly shift: “Changes to roles as a direct result of AI need to be balanced with corporate and social responsibility principles. It must be done in the right way. For example, reskilling people into new roles.”

Algorithmic biases

Algorithmic bias, which is a vital yet often overlooked issue, is another problem that firms must consider. It’s important to remember that AI is only as objective as the data set it is trained on—if the training data is biased, the AI system will be biased. For example, if the historical financial data used to train an AI system reflects past biases, such as specific geographies and sectors being over or under-represented, the system may wrongly overlook these areas or pay them too much attention.

AI Implementation: A Balancing Act

There is no doubt that AI implementation offers investment firms many benefits: improved data analytics, automated due diligence, enhanced market research, improved financial modelling and forecasting, roleplaying opportunities and personalised client engagement. However, the risks must also be carefully considered—job losses, security weaknesses and algorithmic biases are potential side effects of AI implementation when it is not adequately managed. Successful AI implementation is not about embracing every available AI tool as quickly as possible but about strategically selecting applications and finetuning processes that align with the specific needs and goals of individual firms.

Palladium AI Impact Assessment

We have established that AI is an important factor in the success and growth of businesses across various industries. With a growing number of businesses relying on AI to streamline operations, enhance decision-making and create new value streams, firms must be able to accurately assess the potential value that AI can bring to their investments—that is where the AI Impact Assessment comes in.

The AI Impact Assessment consists of two key stages: AI Readiness and Opportunity and AI Value Estimation and Implementation Roadmap. The initial AI Readiness and Opportunity Assessment involves a thorough evaluation of the client’s portfolio companies to determine their current level of AI adoption and readiness. The AI Value Estimation and Implementation Roadmap, the second stage of the impact assessment, involves working closely with Palladium’s team of AI experts to assess the ROI from AI projects and create a detailed roadmap outlining the steps for successful AI integration.

Find out more about the Palladium Digital AI Impact Assessment. Contact us today to learn more about how we can help.