How consumers interact with health products and services in the UK has changed. As the NHS strains under an ageing population and the fallout from the pandemic, individuals are taking more responsibility for their health.

Key Takeaways

- Consumers shifting towards personal responsibility instead of relying on the strained NHS is reflected in increasing consumer health spending.

- Key segments, such as vitamins, minerals and supplements (VMS), sports nutrition, women’s health and digital health solutions, are of continued interest to private equity firms.

- The use of AI in consumer health is set to redefine patient engagement and care plans, offering ample value creation opportunities.

- Bayer’s high-profile unveiling of its Precision Health business unit underscores the industry’s recognition of digital healthcare solutions as a growth catalyst.

- Despite continued headwinds, the consumer health sector presents numerous investment opportunities, especially in resilient segments.

Personal responsibility

In a survey of 1,000 UK consumers, participants were asked to reflect on this statement: “To me, responsibility for achieving overall good health lies with…” Participants were asked to provide a score between 0 (responsibility lies with medical experts) and 100 (responsibility lies with the individual), resulting in a UK average of 62.3. This finding demonstrates a clear sentiment that UK consumers lean more towards personal responsibility, and this attitude is opening doors for consumer health companies.

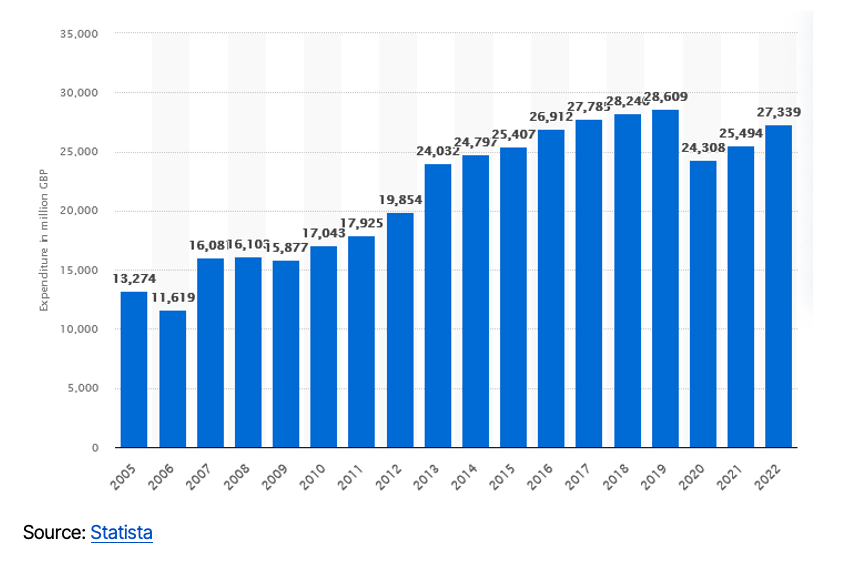

This sentiment has translated to rises in health spending, revealing that individuals are following through on their promises of healthier lifestyles. In 2022, consumer expenditure on health products and services reached £27.3 billion, a substantial increase compared to the previous year.

To capitalise on this trend, investors pursued consumer health assets. As a result, 2021 was a particularly strong year for consumer health M&A. Pent-up pandemic demand, strong capital markets, and the growing self-care trend contributed to high levels of activity. However, transactions fell in 2022 as markets cooled, which continued into 2023. Given the macroeconomic environment and continued cost of living challenges for consumers, activity in 2024 is likely to remain relatively subdued.

Consumer Health Segments to Watch in 2024

Despite the challenging macroeconomic environment, several consumer health segments, including vitamins, minerals and supplements, sports nutrition, women’s health and digital health solutions, show promising signs of life as consumers focus more on overall well-being.

Vitamins, minerals and supplements (VMS)

The VMS market in the UK was £1.5 billion in 2023 and has grown at an average of 13.3% annually since 2018. There is increasing demand for natural and organic products as consumers become more conscious about the ingredients in the products they consume. In 2022, over 16 million people in the UK consumed vitamins or supplements.

Customers seek options free from artificial preservatives and additives to improve their health and reduce their environmental impact. The VMS market has consistently commanded strong valuations in recent years, and this segment will likely continue attracting investor attention despite the current macroeconomic environment.

Sports nutrition

Sports nutrition has seen the highest growth of any consumer health segment over the past five years, and it continues to have a favourable outlook despite economic headwinds. However, in the absence of significant pharma and private equity activity, consumer packaged goods (CPG) companies are moving into the space, with several acquisitions in recent years.

In 2021, Mondelēz acquired performance nutrition business Grenade, The sports nutrition space is attractive for CPG companies, as they are experienced in operating high-scale, low-margin business models. About the acquisition, Chairman and Executive Officer of Mondelēz International, Dick Van de Put, said: “This is another exciting opportunity to deliver on our strategy to be a global leader in broader snacking, including in the important area of well-being."

Women’s health and femtech

Interest in women’s health solutions is on the rise, with a focus on empowering women with fertility and menopause treatments. The segment has attracted growing interest from investors over the last few years. For example, in July 2023, femtech start-up Béa Fertility raised £2.5 million to launch its at-home fertility treatment in the UK. Adora, a platform that supports employees going through menopause or perimenopause, secured £875,000 in funding in July 2023. Hertility, an at-home hormone and fertility test company, raised almost £2 million in May 2023.

Digital health solutions

Healthcare is shifting toward digital, in-home solutions to alleviate consumers’ frustrations with traditional in-person healthcare. This marks a shift toward consumer convenience and accessibility, bypassing some of the pain points of in-person care.

At the helm of this shift are digital health solutions that integrate seamlessly into consumers’s lives. For example, telemedicine platforms are making strides in this new era of technology-enabled consumer healthcare. Faced with a health system under pressure, it appears that consumers are increasingly open to using telemedicine platforms—eMed (formerly Babylon Health) claims it hosts 1.2 million appointments annually, while AI-powered symptom assessment app Ada boasts over 13 million users.

Health tracking platforms have also gathered steam in recent years. For example, Thriva, at-home tests for over 50 health markers, has cultivated an expansive customer base of over 200,000 users. Wellness apps have offered consumers a self-help route defined by affordability and access. For example, digital wellness platforms offer guided meditation and mindfulness exercises. Platforms like Headspace and Calm are popular with consumers, each gaining 1.27 million and 1.95 million downloads in Q3 2023, respectively.

Redefining the consumer health journey

The shifting health landscape reveals various opportunities to redefine consumer access and empowerment throughout their health journey. As traditional healthcare models strain under growing pressures, consumers demonstrate a growing appetite for technology-enabled care, prevention-focused products and personalisation—areas primed for investment. While the macroeconomic environment remains a challenge, opportunities can still be found for private equity firms to invest in resilient subsectors with growth potential.

Consumer Health’s Digital Transformation Drive

Digital transformation has brought value across many sectors, and the consumer health market is no exception. The pandemic acted as a catalyst for the digitalisation of the consumer health sector, with digital health solutions moving from a niche market to a mainstream requirement. However, not all consumer health businesses have the same level of digital maturity. This presents both challenges and opportunities for private equity firms interested in acquiring consumer health assets.

On one hand, firms must thoroughly assess the digital readiness of potential investment targets, considering data analytics capabilities and the integration of digital technologies such as AI. On the other hand, businesses that have not reached digital maturity provide the potential for substantial value creation.

AI is high up on the agenda

The use of AI in the consumer health space is not new. However, the proliferation of generative AI solutions has made the technology more accessible for consumer health businesses looking to appeal to consumers. One survey found that as many as 60% of consumer health marketing and sales teams have not yet incorporated AI into their operations. Companies that use AI tend to incorporate the technology into back-end operations rather than use it to connect with customers.

The advancement of generative AI and its applications, such as better patient engagement and personalised care plans, will attract more interest as consumer health players look to either acquire or bolster existing capabilities through strategic M&A.

Bayer: Seizing digital and digital-supported consumer healthcare opportunities

Over-the-counter (OTC) players are stepping up their investment in digital self-care. Arguably, one of the most prominent digital health endeavours launched in 2023 was Bayer’s Precision Health business. In a statement, Bayer announced it would “prioritise developing products that enable people to take greater control of their own personal health through digital solutions that facilitate more informed choices based on personal insights and novel delivery mechanisms.”

The pharmaceutical company stated that the new Bayer Precision Health group will be responsible for closing the gap between monitoring, awareness and diagnosis on one end and education, treatment and prevention on the other by identifying digital and digitally-supported consumer healthcare opportunities.

Bayer’s Precision Health business is a blueprint for how consumer health businesses can better meet customers’ needs. By adopting a consumer-centric approach that addresses market haps and creates sustained value via digital health initiatives, Bayer’s new business unit underlines the importance of digital innovation as a catalyst for value creation.

Partner with The Palladium Group to Make Digitally-Led Change

The UK consumer health market is ripe for digital transformation. However, to make the most of the opportunities available, firms need the tools and expertise to make informed decisions and execute effective value creation strategies.

As your growth execution partner, The Palladium Group can help you formulate a roadmap to help you meet your strategic goals. Our team of digital experts are poised to deliver robust due diligence and tailored value creation strategies to guide you through the deal lifecycle, offering value at every step.

Please contact us today to learn more about how we can help you capitalise on consumer health opportunities.