How digital trends predicted how a new breed of investor would behave

Over the past six months, we have witnessed a surge of interest in public market trading from a new breed of retail investor. Stocks and shares are no longer the preserve of the professional steeped in years of financial markets experience. Every day consumers are now getting in on the act.

The impact of this ascendant investor class has been most pronounced with the arrival of so-called “meme stocks” - investments that experience high levels of price volatility, driven by exposure on social media platforms such as Reddit and Twitter.

American high street gaming retailer GameStop, for example, was priced at around $19 a share at the end of last year. But its value skyrocketed through January, closing at a $347 peak.

Stocks and shares are no longer the preserve of the professional steeped in years of financial markets experience.

This incredible increase captured both media and public attention, taking a subject matter that is typically restricted to the financial news pages into the main news cycle and onto social media feeds, adding further fuel to the fire.

Search demand for trading and investment platforms

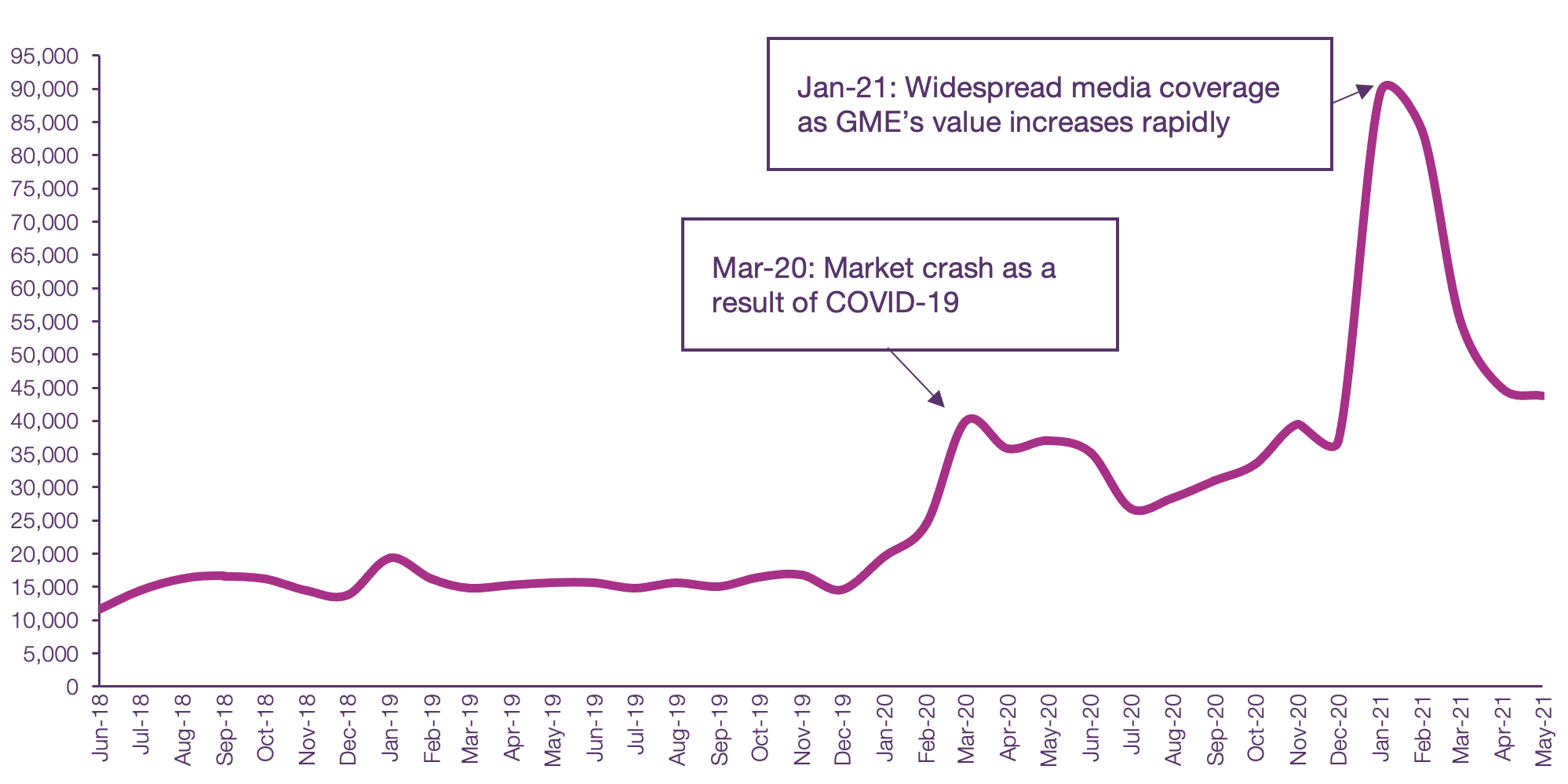

Meanwhile, this chart reveals how the volume of online searches for trading and investment platforms spiked in January, coinciding with increased media coverage of GameStop. Smaller peaks can also be seen in March 2020, as financial markets collapsed due to Covid, leading to a flurry of articles extolling the virtues of investing at the bottom of the cycle.

Overall, this reinforces the idea that consumer interest in investing increases when financial opportunities hit the headlines and then cross over into the world of social media. The peak generated by GameStop has simply take the trend to new levels.

Insight into the priorities of these new investors can be identified from the relevant top search queries. Nine out of the top ten searches allude to trading on mobile or via a mobile application. This suggests that convenience and the ability to make an investment at a moment’s notice is a key factor for the retail investor.

This also potentially downplays the importance of having multiple monitors of financial charts to hand, an image typically associated with institutional investors. The fact that “best trading app” is the most searched query suggests limited pre-existing awareness of trading applications, with new investors looking to research the most suitable platforms. High volumes of searches for “free trading app”, meanwhile, allude to a consumer priority of low investment fees.

Overall, this year has seen a substantial increase of beginner retail investors into financial markets, driven primarily through the media coverage of “meme stocks”. Whether these investors make it “to the moon!” or are left bag-holding remains to be seen. However, what can be said, is that investing has become more accessible than ever before, with numerous mobile applications making the process more convenient and less intimidating for everyday individuals.

And, of course, the democratisation of investment is just one example, in one sector, of how online data acts as an indicator for shifts in consumer behaviour. At Palladium we are experts at identifying relevant data points to test hypotheses around audience behaviour and engagement, as well as how to utilise digital levers to capitalise on this trend.

Palladium is a digital and technology due diligence provider and digital transformation partner to Private Equity firms and their portfolios across Europe and the US. Palladium was named by Real Deals as 2020 Specialist Advisor of the Year at The Private Equity Awards.