A new technological revolution has started with the democratisation of AI-powered solutions such as ChatGPT which will disrupt the business models of many service-based firms that cater to both B2B and B2C audiences. Service companies have historically been safeguarded against technological disruption, as machines were unable to replicate human cognitive abilities and communication skills. However, this protection is no longer guaranteed, as an increasing number of innovative challengers with lean operating models are entering the market. Furthermore, incumbents are now also adopting these models to remain competitive in the face of disruption. The service sector is experiencing commoditisation trends leading to constant price pressure and making it difficult for firms to distinguish themselves from competitors. Service firms rely on the specialisation and differentiation of their offerings, charging premium prices. However, scaling their businesses usually necessitates a proportional increase in headcount, which in turn drives up costs and limits growth potential.

To address these challenges, many service-based firms are turning to service productisation as a means of protecting their margins while scaling rapidly and building a competitive advantage. One such example of innovative integration is the UK-based physiotherapy business, Ascenti, which acquired the Dutch start-up, Reach to drive automated diagnosis, exercise generation and management. By incorporating self-service physiotherapy into their value proposition, Ascenti aimed to expand its patient reach and alleviate the burden on its therapists. Another noteworthy instance is the partnership between law firm Allen & Overy and OpenAI-backed Harvey, which led to the development of a chatbot capable of conducting contract analysis, due diligence, and regulatory compliance work, revolutionising legal capability. Technology presents services firms with an opportunity to overcome their challenges. By harnessing standardisation, algorithm-driven automation, and data analytics to productise certain aspects of their operations, innovative firms can enhance margins as they expand while providing superior service at competitive prices, much like product companies such as Google and Adobe.

These productised services, capable of handling a high-volume of tasks and supporting judgment-driven processes, improve productivity and efficiency, therefore enabling nonlinear scaling. This approach allows highly compensated professionals to focus on more sophisticated tasks, ultimately generating increased value for the organisation.

Private equity investors are increasingly seeking to productise their portfolio companies' services as a strategy to achieve higher exit valuations, diversify their revenue streams, and attract new customers. Industry reports and expert analysis suggest that investments in companies with productised services have been on the rise as these companies often experience higher revenue growth compared to their non-productised counterparts. According to a report from Alix Partners, productisation activities such as the implementation of Operational Efficiency, AI and Analytics, Strategic Platforms and Product Growth can increase a portfolio company’s EBITDA by 7% - 15% which in turn will drive higher valuation multiples, particularly if the firm is tech-enabled and has developed valuable IP.

However, service productisation is not a one-size-fits-all solution, and firms must determine the best approach based on their strategic goals and appetite for transformation. In this article, we provide a guide to service productisation, including what it is, how Palladium has implemented it, what benefits to expect, and what challenges to anticipate. By adopting service productisation strategies, service-based firms can protect their margins, compete more effectively, and achieve long-term growth.

Embedding products into services to drive profitable growth

In the services sector, productisation entails transforming customised offerings into a collection of packaged value propositions that are standardised, automated, enriched with analytics, and monetised in novel ways. This approach diverges from conventional service delivery models, which predominantly revolve around selling time and billing hours.

Productising services allows businesses to shift towards selling outcomes and constructing systems, rather than merely delivering services on an hourly basis. These productised services present customers with a fixed and transparent price, unambiguous scope, timeline, and outcomes, and therefore eliminate the uncertainty in scoping, delivering, and billing tasks.

Furthermore, productisation empowers companies to transition from providing all-encompassing solutions to presenting a selection of options from which customers can choose. This evolution in working methods can yield significant advantages for both service providers and customers, encompassing enhanced efficiency, increased scalability, reduced costs, and better alignment with customer requirements.

Leveraging existing services as a starting point for a broader product strategy is a valuable approach, as these services have already gained traction and generate revenue. The objective is to capitalise on a service's existing success by transforming it into a scalable product that drives revenue growth and cost reduction, thus providing the organisation with the impetus required for more transformative and innovative product-led changes.

The Product Innovation Maturity Journey Framework

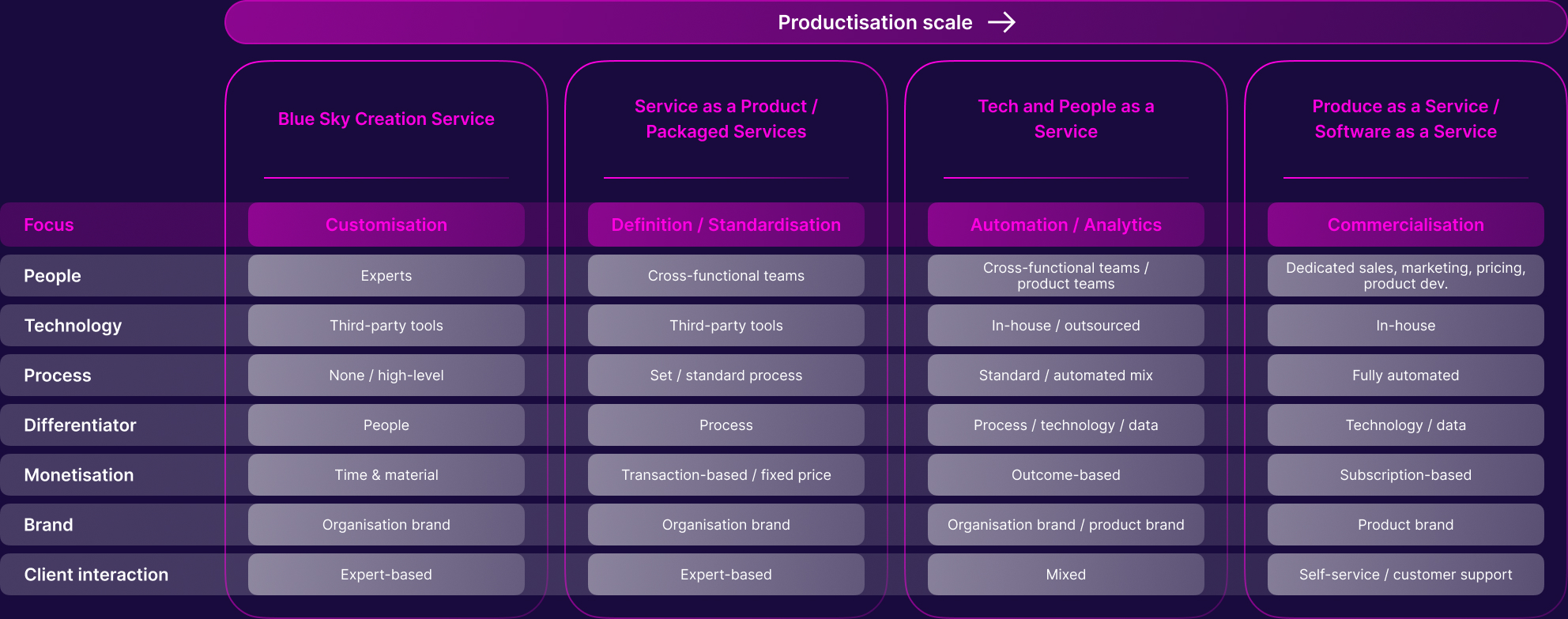

To assist investors and portfolio companies in navigating the complexities of service productisation, Palladium has devised a product innovation maturity journey framework for service firms:

1. Blue Sky Creation Service

The initial stage of productisation maturity is characterised by human-resource intensive, knowledge-driven services. These services are highly customised and can yield significant returns, but they are challenging to scale due to the need for additional personnel to serve more clients. This stage is very "hands-on" and dependent on key individuals, with clients often purchasing the services based on the person delivering them.

Newly formed professional services firms typically fall into this category when they offer a wide range of services but have not yet established their service package or have insufficient capacity to standardise their operations. Such firms possess versatile resources capable of performing various tasks and provide customised quotes to their clients.

2. Packaged Services (or Service as a Product)

The subsequent phase, Service as a Product or Packaged Services, relies heavily on human resources but standardises the process so that all customers receive a consistent experience and outcome at the same price. The service is deconstructed into its essential components and sold as a defined package of activities, each with a clear scope, process, and output. At this stage, any resource can deliver the service, as its definition has been refined to the point where little variance exists, requiring less oversight.

Standardisation forms the basis for providing an optimised and consistent price to all customers, minimising the risk of exceeding the scope or incurring additional costs. The organisation's differentiator shifts from individuals and teams to the processes that support their daily activities. A prime example of this can be found in B2C services such as mobile network and broadband companies that have honed customer service or sales excellence, successfully scripting interactions with customers to ensure optimal outcomes.

4. Tech and People as a Service

The next advancement, Tech and People as a Service, involves incorporating technology and/or internal products to automate standardised tasks from the previous phase, thereby supporting human resources in performing their activities efficiently. In this model, the product is integrated into the service offering and marketed as a component of it. Services remain the core of the value proposition, with customers primarily purchasing the service offering rather than the product itself. From the customer's perspective, the primary change lies in the reduced pricing of the service as the value generated by the new product is shared between the firm and its clients.

In-house or third-party developed technology facilitates the transition from purely human-powered services to a hybrid model that necessitates less human involvement in delivering value. At this juncture, it is advisable for companies to allocate dedicated resources to the project, ensuring it remains distinct from business-as-usual activities. For most service firms, the primary focus lies in the gathering and analysis of data, such as delivering reports for a consultancy or managing administrative data for a clinic.

4. Software-as-a-Service (or Product-as-a-Service)

At the top of the progression is the Product-as-a-Service model, which features a fully automated, self-service offering available to customers through a subscription-based system. By paying a fee, customers gain continuous access to a well-maintained and regularly upgraded service, ensuring they receive the best value from their subscription.

Many service-focused firms are now developing technology platforms that are designed to complement their traditional consulting services. This innovative approach often leads companies to keep the technology in-house, allowing them to protect their intellectual property and new differentiators while keeping the capability close to the core business for optimal innovation.

As the shift towards a Software-as-a-Service (SaaS) business model occurs, it becomes necessary to create a unique brand identity for the product to differentiate it from the core offering. This transition also calls for dedicated marketing, sales, and support teams to ensure ongoing growth and maintain a strong commitment to addressing the needs and expectations of the user-base.

Palladium’s Journey to Productisation – The Prism Story

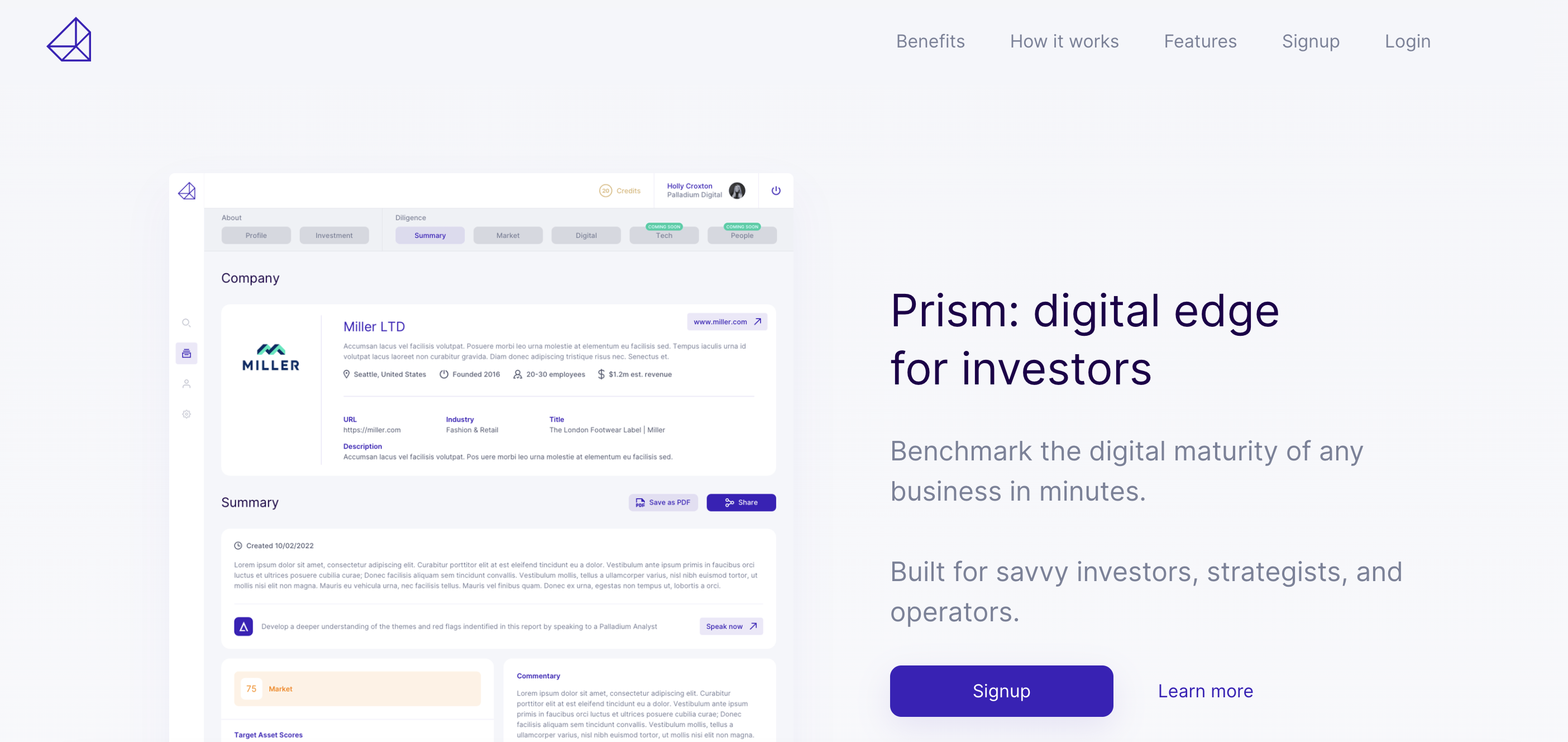

In 2020, Palladium embarked on an ambitious journey to develop Prism, a cutting-edge B2B SaaS solution catering to investors, strategists, and operators seeking a competitive advantage in assessing digital maturity of businesses. Designed as a response to the growing challenges faced by service businesses in scaling revenue with limited resources, Prism was set to address post-Covid trends such as talent competition, the great resignation, and remote working, ensuring Palladium continued to deliver exceptional services to its clients.

Palladium's vision for Prism was to extend their consultants' knowledge and expertise beyond traditional office hours, creating a highly accessible and automated product. This would allow clients to make better-informed decisions using a data-driven service, independent of consultant availability.

The journey commenced with standardising Palladium's due diligence services by implementing defined scopes, processes, and templates, enhancing delivery speed and consistency, while reducing reliance on experts for data collection and initial analysis. This refinement allowed for improved scoping and quoting processes, resulting in more accurate pricing and a streamlined sales cycle.

With a clear vision and value proposition, Palladium mobilised dedicated resources to initiate Prism's development, emphasising focus and commitment. This approach mitigated translation overhead and potential distractions associated with outsourcing or shared resources.

To digitise the due diligence team's knowledge and output, Palladium integrated subject matter experts into the product team, creating a comprehensive knowledge base to replicate consultant processes with high fidelity. Incorporating customer input, they co-designed the solution with private equity clients, refining its interface to better meet their functional and emotional requirements.

Following 18 months of development, Prism successfully onboarded over 50 clients during its private beta phase, becoming an integral component of the due diligence workflow and amplifying the impact of Palladium's consultants.

Once a product-market fit had been established, validated through the number of customers onboarded and their frequent engagement with the product, the next phase of the Prism productisation journey involved assessing customers' willingness to pay. This would help define the pricing and go-to-market strategy, allowing the proposition to be successfully launched into the market.

The journey to productise Palladium’s due diligence services raised questions about the risk of cannibalisation but ultimately the firm’s consultants are inputting at a higher value delegating low-value activities to Prism so the client gets a higher value product.

Service Productisation is a Strategic Exercise

Whether or not your business should engage in a productisation activity or to what degree of productisation can be achieved, and how this can be achieved, requires thorough thought and planning. Palladium has outlined below a few considerations you should think about:

- Understand the portfolio strategy and investor profile

Investors must carefully evaluate their portfolio strategy and possess a comprehensive understanding of their investor profile when determining the extent of their engagement in the productisation journey. The transformation towards a SaaS business model significantly influences a company's operational and business framework, altering its growth trajectory. During the transition phase, investments in R&D are essential, with returns potentially materialising within one to two years. This timeline may not align with the preferences of those seeking steady growth and lower risk, as opposed to high-risk/high-yield investments. Such considerations will undoubtedly shape the approach to the transformation journey and the degree of productisation that can be achieved.

- Understand how it aligns with the broader value proposition and strategic outlook of the firm

The productisation journey ought to be seamlessly integrated within a company's overarching digital strategy rather than existing as an isolated or arbitrary decision. A profound understanding of the organisation's objectives and goals is essential, along with a robust digital strategy that articulates and executes this vision. Embarking on the service productisation journey demands unwavering dedication to digital initiatives, spearheaded by leadership to guarantee continuous and consistent support throughout the process. Firms adopting a digital-first strategy are more likely to succeed, as technology becomes ingrained across all business facets. The ability to prioritise digital advancements as a key strategic focus will ultimately distinguish flourishing companies from those struggling to thrive.

- Understand the market demand and customer needs

A firm seeking to productise its services must carefully assess market demand and customer requirements, as the transition towards standardised, automated, and self-service offerings may not be universally appropriate for all markets, customer segments, or specific journey stages. For instance, certain customer segments may demand white-glove, customised services and be willing to pay a premium for a high-touch, low-tech approach.

Moreover, some aspects of the customer journey may necessitate human interaction, particularly in situations requiring personalised attention or complex problem-solving. These critical touchpoints should be handled with care. Conversely, other parts of the journey may benefit from automation, particularly in areas where bottlenecks negatively impact the customer experience. For example, initial inquiries, onboarding, self-service portals, and post-sales support could be ideal candidates for automation.

Understanding customer price sensitivity is also crucial, as it can inform cost optimisation strategies for clients content with a low-cost service. This insight may even reveal new market segments for the firm to explore.

- Evaluate the competition and the space

Assessing the competitive landscape is a critical consideration for firms seeking to transition to a more productised service delivery model, such as a software-as-a-service (SaaS) solution. Understanding the offerings, features, and price points of other SaaS providers can inform the development of a more competitive product or service. Comprehensive analysis should encompass factors such as product functionality, user experience, pricing, customer support, and marketing strategies, providing valuable insights.

Moreover, companies should examine the overall customer experience provided by their competitors, encompassing aspects such as customer satisfaction ratings, online reviews, and social media sentiment. By evaluating these elements, an organisation can develop a deeper understanding of the competitive landscape and formulate a product strategy that effectively caters to the needs of its target customers while maintaining a competitive edge.

- Assess the internal capabilities and resources – Buy vs Build vs Acquire

In line with digital strategy considerations, evaluating whether a business should develop internal capabilities is crucial for determining the most appropriate course of action and minimising unnecessary costs and risks.

Primary factors influencing the "buy vs. build" decision include competitive advantage and cost. Developing a product in-house can enable businesses to create a unique, customised, and differentiated offering, fostering a competitive edge. Conversely, purchasing a product can expedite time-to-market and diminish the risk of development failure, which may also contribute to a competitive advantage.

In-house development necessitates substantial investments in resources, such as talent, infrastructure, and technology. Opting for an existing product or licensing technology from a third party might be a more cost-effective alternative. Additionally, purchasing a product can save time and mitigate development risks, as the product will have already undergone testing and may have an established user base.

Another option to consider when evaluating the "buy vs. build" decision is acquisition. Acquiring a company that already has the necessary product or technology can offer several benefits. It can provide immediate access to a mature product or technology, as well as an existing customer base and market share. Additionally, it may also bring in new talent, expertise, and intellectual property. However, acquiring a company can also be a complex and time-consuming process, involving due diligence, negotiations, and potential integration challenges. Businesses must carefully assess whether acquisition aligns with their overall strategy and resources, and whether it represents a feasible and cost-effective option in the long run.

Beyond cost, other considerations should also be examined. For instance, businesses should assess their internal capabilities to determine if they possess the requisite expertise for in-house development. Furthermore, they must evaluate whether they have the resources to support ongoing product maintenance, support, and updates.

Palladium’s Approach to Getting Started

Palladium has developed a comprehensive two-stage approach to support businesses in their journey towards productisation: Candidate Identification and Product Strategy. The initial stage involves conducting a high-level assessment of the company's service portfolio to identify services with a high potential for productisation. This is followed by the Product Strategy phase, where the digital solution is designed and defined to capitalise on the opportunity.

To assist businesses in embarking on this journey, Palladium offers a set of key questions and a structured approach:

-

Are you primarily a product or service company? What is your service-product mix?

A mapping and review of the products and services sold by the company will help in understanding the breadth of offerings, target segments, personas and end-to-end journeys for each of them.

-

What is your strategy, value proposition and which services do you excel at (USPs)?

Facilitating interviews and workshops with senior leadership can help capture the strategic intent of the company and set boundaries for the productisation activity.

-

Which services/products are your best sellers/higher volumes?

Reviewing data to capture and analyse the company's service and product value and volume can help identify services that are in high demand and have a consistent revenue stream. These services are more likely to be successful as products. -

Could and where will productisation add the most value to my business?

Performing process mapping and customer research can help identify services that are repetitive, low-value and where human-capital is a limiting factor. These represent the best candidates for productisation as they can be automated or packaged into a product.

-

What is the level of complexity and customisation of your core solutions? What components of the service are the most costly as variable components and can they be standardised?

If the service is simple and easy to replicate, it may be a good fit for productisation. Evaluating the scalability of the service and its potential to be delivered remotely or through software are key characteristics of successful products.

-

What are the best candidates for productisation?

Performing an assessment of each service productisation potential and prioritising the services that have the highest potential for success and develop a plan to productise them. -

How would the perception of your customers change if you standardise or automate your services?

Once a potential service for productisation has been identified, conducting further research to validate the market demand and the potential return on investment.

Conclusion

In conclusion, this article has delved into the concept of service productisation, offering crucial insights for companies aiming to boost their growth. By systematically transforming intangible services into scalable products, productisation brings numerous benefits such as consistent customer experiences, streamlined operations, and sustainable revenue streams.

Although challenges like complexity, cultural shifts, and the need for ongoing innovation may arise, careful planning and execution can help overcome these obstacles. I encourage readers to assess their services and portfolios, viewing productisation as a key growth strategy. By doing so, businesses can differentiate themselves, generate value for clients, and cultivate enduring relationships.

Ultimately, service productisation serves as a potent instrument for enhancing service delivery, maximising efficiency, and seizing market opportunities. Companies that proactively embrace this approach will establish a robust foundation for future growth and success.

Palladium has acquired considerable expertise in the field of product development. Our credentials in this area can be shared with you and if you would like to discuss your productisation needs, please feel free to email me at medy.ract@palladiumdigital.co.uk

Prism has officially launched as a subscription-based offering. To provide potential clients with an opportunity to experience the platform first-hand, Palladium is extending a 1-month free trial. For those interested in exploring the benefits of Prism and its transformative capabilities, feel free to visit Prism website.

Get in touch to learn more about how Palladium can support your next transaction.